Exploring Reverse Mortgages: How to Make an Informed Decision

A reverse mortgage is a type of loan that allows homeowners, typically aged 62 or older, to convert part of the equity in their home into cash.

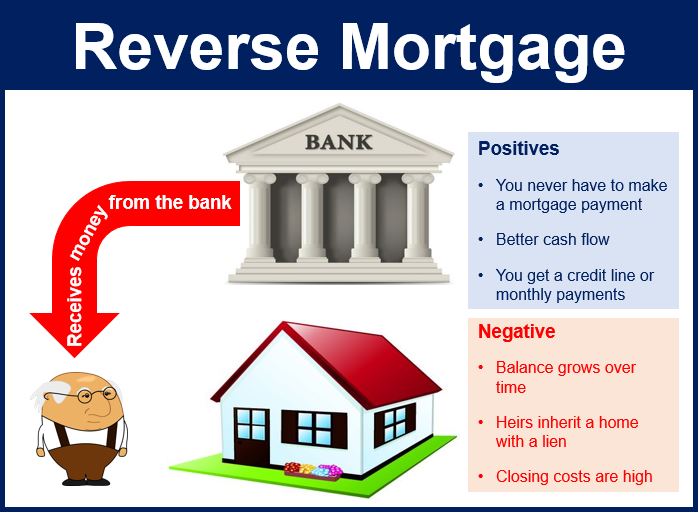

In a traditional mortgage, you pay monthly payments to your lender, but with a reverse mortgage, you receive payments or a lump sum based on the equity in your home.

What is the Process of Getting a Reverse Mortgage?

When you take out a reverse mortgage, the equity in your home is used as collateral for the loan.

Several factors determine the loan amount, including your home's appraised value, your age, and the current interest rate.

Typically, homeowners who qualify for a reverse mortgage are able to access a portion of their home equity, which is paid to them either as a lump sum, monthly payments, or as a line of credit.

Who Qualifies for a Reverse Mortgage?

Eligibility for a reverse mortgage requires the homeowner to be 62 years or older, with sufficient equity in their home.

For your home to qualify for a reverse mortgage, it must be your primary residence and meet certain standards for maintenance and condition.

What are the Pros and Cons of a Reverse Mortgage?

A reverse mortgage can provide financial relief for seniors, offering extra income or a lump sum with no need for monthly payments.

On the flip side, interest and fees accumulate on the loan, which means that your home’s equity will gradually decrease over time.

Your heirs may face challenges when it comes to repaying the loan, as it becomes due when you pass away or move out, and the home may need to be sold.

Is a Reverse Mortgage Right for You?

You should carefully assess your financial needs and retirement goals before deciding whether a reverse mortgage is the right choice.

Consulting a financial advisor can help you determine if a reverse mortgage aligns with your financial goals, especially regarding your home’s equity and inheritance.

In the end, a reverse mortgage can be a helpful tool for those needing extra financial support in retirement, but it’s crucial to weigh both the pros and cons before moving forward.

Summary

To sum up, a reverse mortgage might provide immediate relief, but it is essential to weigh the pros and cons before committing.

A reverse mortgage can be a helpful tool for some, but make sure you fully understand it before making any decisions.